Managing your finances can be challenging. Budgeting apps make it easier.

In today’s fast-paced world, keeping track of expenses is crucial. Budgeting apps help you monitor spending, save money, and reach financial goals. With so many options available, finding the right app might seem overwhelming. This blog post will guide you through the best apps for budgeting.

We’ll explore their features, benefits, and how they can simplify your financial life. By the end, you’ll have a clearer idea of which app suits your needs. Ready to take control of your finances? Let’s dive in!

Table of Contents

Introduction To Budgeting Apps

Managing money can be hard. Budgeting apps make it easier. These apps help you track your spending and plan your finances. They keep you on top of your financial goals. This blog post will introduce you to the best budgeting apps available.

Why Use Budgeting Apps

There are several reasons to use budgeting apps:

- Ease of Use: Budgeting apps are user-friendly.

- Real-Time Tracking: They track your spending in real-time.

- Goal Setting: You can set and track financial goals.

- Notifications: Get alerts for bills and payments.

Benefits Of Budgeting Apps

| Benefit | Description |

|---|---|

| Financial Awareness | Understand where your money goes. |

| Expense Tracking | Track every expense, big or small. |

| Budget Creation | Create and stick to a budget easily. |

| Savings | Identify areas to save money. |

Top Free Budgeting Apps

Managing your finances can be tough, but budgeting apps make it easier. There are many free options that help you track your spending, save money, and plan for the future. Here are some of the top free budgeting apps to consider.

Mint

Mint is a popular budgeting app that offers many features. It links to your bank accounts, credit cards, and bills, providing a complete picture of your finances. Mint categorizes your expenses automatically, making it easy to see where your money goes.

- Track your spending

- Set budgets and goals

- Receive bill reminders

- Get personalized tips

Mint also offers free credit score monitoring. This helps you stay on top of your credit health. The app is user-friendly and works well for beginners and experienced budgeters alike.

Pocketguard

PocketGuard is another excellent free budgeting app. It focuses on simplicity and ease of use. PocketGuard connects to your bank accounts and tracks your spending. The app shows you how much money you have left after bills and necessities.

- See your “In My Pocket” amount

- Track your spending by category

- Set and track savings goals

- Identify subscriptions you can cancel

PocketGuard helps you avoid overspending by showing your available funds. It’s a great tool for anyone who needs a clear picture of their finances.

| Feature | Mint | PocketGuard |

|---|---|---|

| Link to bank accounts | Yes | Yes |

| Automatic expense categorization | Yes | Yes |

| Bill reminders | Yes | No |

| Credit score monitoring | Yes | No |

| Savings goals | Yes | Yes |

Both Mint and PocketGuard offer valuable tools to help you manage your money. Choose the one that best fits your needs and start budgeting today.

Best Paid Budgeting Apps

Managing your finances is crucial. Paid budgeting apps offer advanced features to help you stay on track. These apps are worth the investment. They provide detailed tools and insights to manage your money better.

You Need A Budget (ynab)

You Need a Budget (YNAB) helps you take control of your money. It’s based on four simple rules:

- Give every dollar a job

- Embrace your true expenses

- Roll with the punches

- Age your money

YNAB offers live workshops and personal support. Its goal is to make budgeting easy for everyone. The app syncs with your bank accounts. This ensures your budget is always up to date. YNAB is available on both desktop and mobile devices.

| Feature | Details |

|---|---|

| Cost | $11.99/month or $84/year |

| Free Trial | 34 days |

| Platform | iOS, Android, Web |

Everydollar

EveryDollar is another excellent paid budgeting app. Developed by Dave Ramsey’s team, it uses the zero-based budgeting method. This means every dollar is assigned a purpose.

EveryDollar syncs with your bank accounts. This makes it easy to track your spending. The app is user-friendly and offers detailed reporting. It also provides access to Financial Peace University for an extra fee. This can help you learn more about managing your finances.

| Feature | Details |

|---|---|

| Cost | $129.99/year |

| Free Version | Available with limited features |

| Platform | iOS, Android, Web |

Both YNAB and EveryDollar are powerful tools. They can help you manage your finances better. Investing in a paid budgeting app can make a significant difference in your financial health.

Credit: goodbudget.com

Apps For Personal Finance

Managing personal finances can be challenging without the right tools. Luckily, many apps can help you keep track of your budget and spending. These apps make it easy to see where your money is going. They also help in planning for the future. Let’s dive into some of the best apps for personal finance that can make a difference.

Personal Capital

Personal Capital is a popular app for managing finances. It offers both budgeting and investment tracking. You can link your bank accounts, credit cards, and investment accounts. This gives you a complete picture of your financial health.

- Dashboard: The app’s dashboard is user-friendly and detailed. It shows your net worth, cash flow, and investment performance.

- Budgeting: Personal Capital helps you create and manage budgets. You can track your spending in different categories.

- Investment Tracking: It monitors your investments and gives you insights. You can see your asset allocation and investment fees.

Personal Capital is great for those who want to keep an eye on their investments while budgeting. It provides detailed financial analysis and planning tools.

Clarity Money

Clarity Money is an intuitive app for personal finance. It helps you manage your budget and track spending. The app uses artificial intelligence to offer personalized insights.

- Expense Tracking: Clarity Money categorizes your expenses automatically. This makes it easy to see where your money goes.

- Bill Management: You can manage and pay your bills through the app. It sends reminders for upcoming payments.

- Subscription Management: The app tracks your subscriptions. You can cancel unwanted subscriptions with a few clicks.

- Savings Goals: Clarity Money helps you set and achieve savings goals. You can create custom goals and track your progress.

Clarity Money is ideal for users who need help managing their day-to-day finances. Its intuitive features make budgeting and saving effortless.

Apps For Family Budgeting

Managing family finances can be challenging. Budgeting apps make it easier to track and control spending. They provide tools to help you stay on top of your budget. Here are some of the best apps for family budgeting.

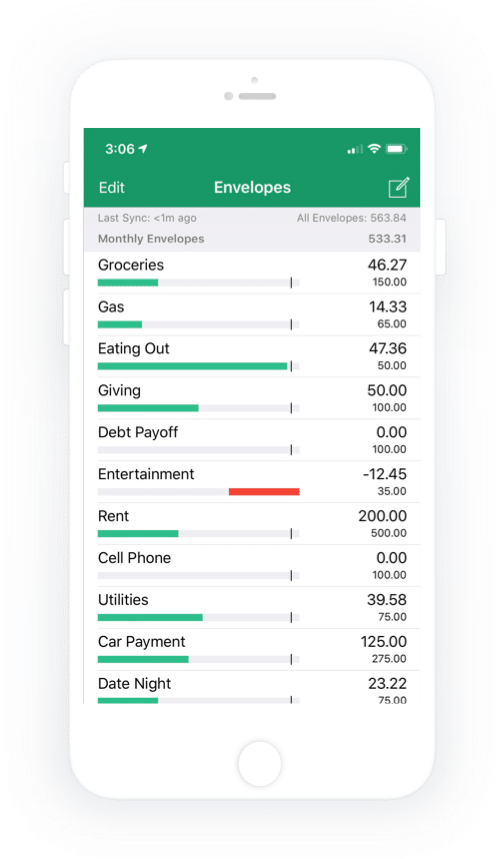

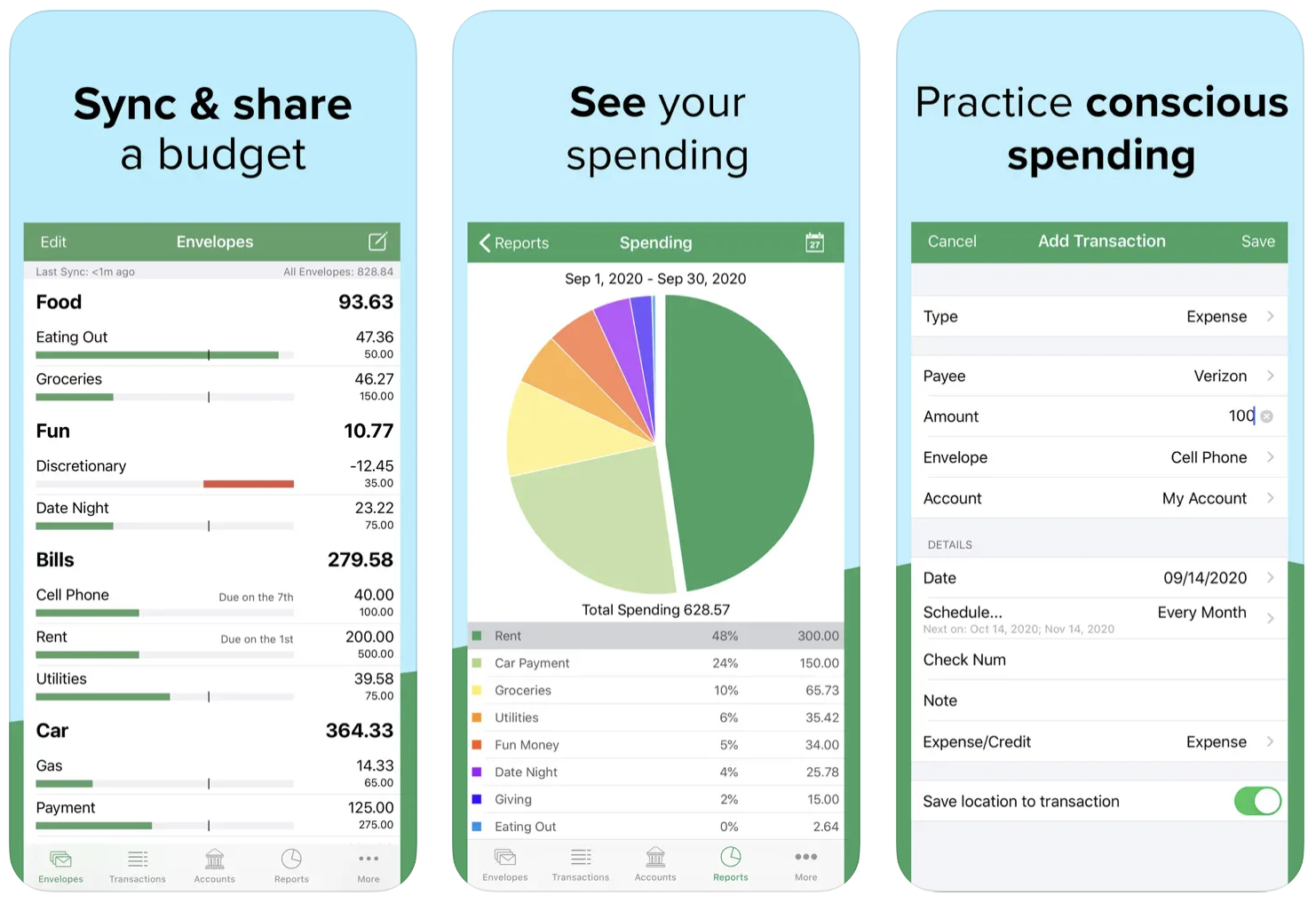

Goodbudget

Goodbudget is a popular app for family budgeting. It uses the envelope method to help you manage your money. You can create envelopes for different spending categories. This way, you know exactly where your money goes.

Goodbudget allows you to share your budget with family members. This feature ensures everyone is on the same page. You can track spending together and make informed decisions.

- Envelope budgeting method

- Share budget with family members

- Track spending together

Goodbudget also offers detailed reports. These reports help you understand your spending habits. They show you where you can cut back and save more money.

Honeydue

Honeydue is designed for couples and families. It helps you manage joint finances and stay connected. You can link all your bank accounts, credit cards, and loans in one place.

Honeydue allows you to set monthly limits for different categories. This helps you stay within your budget. You can also split expenses and share bills with family members.

- Link all bank accounts, credit cards, and loans

- Set monthly limits for categories

- Split expenses and share bills

Honeydue also provides reminders for upcoming bills. This feature helps you avoid late fees and stay on top of your finances.

| App Name | Key Features |

|---|---|

| Goodbudget | Envelope budgeting, share budget, track spending |

| Honeydue | Link accounts, set limits, split expenses, bill reminders |

Credit: techcrunch.com

Features To Look For

Finding the best budgeting app can make managing your money much easier. But what features should you look for? Here are some key features that can help you stay on top of your finances.

Expense Tracking

Expense tracking is crucial for any budgeting app. It helps you see where your money goes. Look for apps that let you:

- Categorize expenses

- Scan receipts

- Link bank accounts

- Set spending limits

These features help you track your spending patterns. They also help you identify areas where you can save.

Financial Goals

Setting financial goals keeps you motivated. Good budgeting apps should let you:

- Set savings goals

- Track progress

- Automate savings

- Get reminders

These features help you stay focused on your goals. They also make reaching your financial targets easier.

How To Choose The Right App

Finding the best budgeting app involves considering features, ease of use, and compatibility with your financial goals. Look for apps that offer expense tracking, budget planning, and financial insights. Choose one that suits your needs for better financial management.

Choosing the right budgeting app can seem overwhelming. There are many options available, each with different features. The right app depends on your personal needs and preferences. Here is a guide to help you make the best choice.

Assess Your Needs

Start by identifying your financial goals. Do you want to track spending, save money, or pay off debt? Knowing your goals helps narrow down your choices. Consider your tech comfort level too. Some apps are simple and easy to use. Others offer advanced features that may require more time to learn.

Think about the type of device you use. Some apps work better on smartphones. Others may be better suited for tablets or computers. Determine if you need an app that syncs across multiple devices.

Compare Key Features

Once you know your needs, compare the features of different apps. Look for apps that offer budgeting tools. These tools help you categorize expenses and track spending. Some apps provide bill reminders. These can help you avoid late fees.

Consider apps that offer goal setting features. These can help you save for specific goals like a vacation or emergency fund. Check if the app provides detailed reports. Reports can give insights into your spending habits.

Security is another important feature. Ensure the app has strong security measures. Look for apps that offer encryption and secure login options. Reading user reviews can also provide valuable insights.

By following these steps, you can find the right budgeting app for your needs.

“`

Tips For Maximizing Savings

Maximizing savings can be easier with the right budgeting apps. These apps help you track spending and manage finances effectively. Below, find essential tips for maximizing your savings.

Regularly Review Your Budget

Review your budget often. This helps you stay on track and adjust as needed. Make it a habit to check your spending weekly.

- Identify unnecessary expenses: Cut down on non-essential items.

- Track your progress: Ensure you are meeting your financial goals.

- Adjust your plan: Modify your budget based on changes in your life.

Regular reviews help you stay aware of your financial health.

Set Realistic Goals

Set goals that you can achieve. This keeps you motivated and on track. Start with small, manageable goals and gradually aim higher.

- Short-term goals: Save for a specific item or event.

- Medium-term goals: Build an emergency fund.

- Long-term goals: Plan for retirement or a major purchase.

Realistic goals make saving money less stressful.

| Tip | Description |

|---|---|

| Review Budget | Check your spending and adjust often. |

| Set Goals | Start with small goals and aim higher. |

User Experiences

When it comes to budgeting apps, user experiences can vary widely. Some people find these apps life-changing, while others face challenges. Let’s dive into real-life stories and common issues users encounter.

Success Stories

Many users have shared their success stories with budgeting apps. These tools have helped them save money, pay off debt, and manage their finances better. Below are a few inspiring examples:

Sarah: Sarah used an app to track her daily expenses. She managed to save $500 in three months. She says the app’s reminders helped her avoid unnecessary spending.

John: John had a lot of debt. Using a budgeting app, he created a plan. In a year, he paid off $10,000. John credits the app’s debt payoff planner for his success.

Emily: Emily struggled with impulse purchases. She used a budgeting app to set spending limits. Over six months, she saved enough for a vacation.

Common Challenges

Not all experiences are positive. Some users face challenges when using budgeting apps. Here are common issues reported:

Technical Glitches: Apps sometimes freeze or crash. This can be frustrating and disrupt tracking.

Learning Curve: Some users find the apps complex. It takes time to understand all features.

Sync Issues: Bank accounts and transactions may not sync properly. This leads to inaccurate data.

Overall, user experiences with budgeting apps are a mix of success stories and common challenges. These apps can be powerful tools for managing finances, but they are not without their flaws.

Frequently Asked Questions

What Are The Best Free Budgeting Apps?

Many great free budgeting apps are available. Top choices include Mint, YNAB (You Need A Budget), and PocketGuard.

How Do Budgeting Apps Work?

Budgeting apps track your income and expenses. They categorize transactions, set budgets, and provide financial insights.

Are Budgeting Apps Safe To Use?

Yes, most budgeting apps use encryption. Always choose apps with strong security measures and positive reviews.

Can Budgeting Apps Help Save Money?

Absolutely, budgeting apps help track spending, identify saving opportunities, and manage finances more effectively.

Conclusion

Finding the right budgeting app can simplify managing your finances. These apps help track spending, set savings goals, and build better money habits. Choose one that fits your needs and lifestyle. Give it a try and see how much easier budgeting can be.

Start taking control of your finances today. Happy budgeting!